Pay for Performance: The Largest Institutional Investors’ View

Executive compensation has been one of the trickiest issues within the corporate governance space as of late. Across the board, there seems to be no end in sight to finding the perfect compensation package or philosophy for corporate executives.

In this article, we will discuss the evolution of pay for performance and the KPIs organizations should be considering to measure performance effectively.

The evolution of pay for performance

The theme of executive compensation came to the forefront following the 2008 financial crisis when senior management at Merrill Lynch got a payout of about $2.5 billion. After running the bank to the ground, the United States Treasury had to force the bank’s assets on other banks. This led several groups to calling for better, more appropriate compensation packages for executives. For instance, in the Netherlands the government passed a law that short term incentive (STI) package for executives within the Financial Services sector shall not be more than 20% of the base salary. In the United States, this led to the enactment of the Dodd Frank Act of 2012, which over the years has ensured accountability in executive compensation practices. For instance, it has led to adoption of double trigger acceleration, rather than single trigger, and virtually eliminated the once prevalent golden parachute within the American corporate culture.

Despite the changes in executive compensation in the last decades, which have led to more companies adopting performance based compensation and discretionary compensation awards, the question has become: What are the right key performance indicators (KPI) for companies to adopt to inform performance based compensation? Over the years, we have seen increases in pay for executives, especially within the large firms, and in some cases, mid-sized companies. The next question is: Do companies have the right KPIs, or have investors not been paying attention to these pay practices?

KPIs to effectively measure performance

In recent years, major institutional investors have put emphasis on having the right KPIs to accurately measure performance. For example, in 2019, the Council of Institutional Investors (CII) adopted a new executive compensation policy, which stated that:

1. Executive compensation should be designed to attract, retain and incentivize executive talent for the purpose of building long-term shareholder value and promoting long-term strategic thinking.

2. Executive compensation should be tailored to meet unique company needs and circumstances. A company should communicate the board’s basis for choosing each specific form of compensation, including metrics and goals.

3. Compensation committees should make compensation disclosures (including those in the U.S.-style Compensation Disclosure & Analysis), as clear, straightforward, and comprehensible as possible. Each element of pay should be clear to shareholders, especially with respect to any goals, metrics for their achievement and maximum potential total cost.

4. Descriptions of metrics and goals in the proxy statement should be at least as clear as disclosures described in other investor materials and calls.

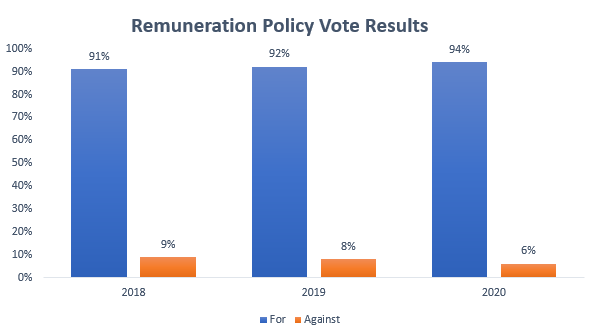

A look at the voting result for remuneration policy of companies between 2018-2020 seem to portray a picture of what the CII is saying.

The graph above shows that overall, shareholders have consistently voted in favor of executive compensation policies put before them, with support growing by 3% from 2018-2020. However, there is a note of caution when it comes to executive pay with respect to performance. Executives tend to have more information than board members and may have more knowledge about the workings of the sector in which they operate. In some cases, they may use this information to their advantage.

This has made institutional investors frown on issuers retrofitting peer groups to make executive compensation decisions. For example, BlackRock notes that while its efficient to track performance of company executives using performance peer groups, companies should endeavor to outperform their respective peer group. In some cases, companies are choosing peer groups that are largely underperforming to improve the view on their own performance. This increases the importance of proxy advisor defined peer groups, such as those by Glass Lewis.

Another challenging issue over the years has been institutional investors’ position towards shareholder proposals to make changes in executive compensation policy. Though there has been continued conversation around this topic, voting results seem to show something different. In 2018, shareholder proposals from some large companies were rejected by an average of 89% of shareholders voting. These proposals were geared towards creating limits to executive compensation and including additional conditions for executive compensation.

There is a need for institutional investors and groups of shareholders to have common stance on executive compensation—more particularly pay for performance—to effectively engage with companies. This includes ensuring the right set of individuals are appointed to the board and the compensation committee.