Be prepared: Learnings from the UK 2018 proxy season

The UK is at the forefront of shareholder concern of good corporate governance practices. In a climate of increasing proactive shareholder engagement, the CGLytics FTSE 100 2018 proxy season review evaluates underlying trends to provide unique insights for being prepared for the forthcoming season.

During the 2018 proxy season, shareholders showed increasing interest in key governance matters, including director election, board effectiveness, CEO pay and Environmental Social Governance (ESG) practices. Transparency emerged as a consistent concern.

We saw unprecedented dissent from investors on director re-elections. The number of resolutions opposing individual director re-elections rose from 38 in 2017 to 80 in 2018. The reason for the increase was due to a general concern about directors becoming ‘overboarded’ and unable to fulfil their duties. Investors were also looking closely if boards possessed the right composition including skills, diversity, and gender to support long-term growth plans.

2018 Proxy Season Highlights

Say on Pay

The GCLytics report explained that CEO pay is a real concern among investors who repeatedly voted down remuneration reports and questioned short-term remuneration plans.

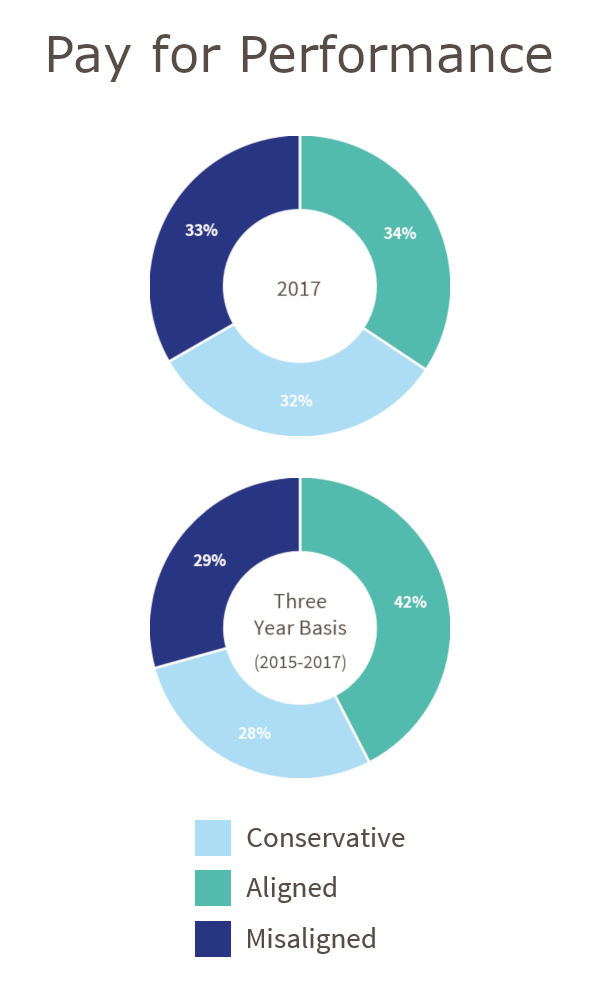

Pay and performance

During the year, shareholders strongly urged companies to bring pay in line with performance and voted strongly against remuneration-related resolutions if it was seen as misaligned.

33% of companies have a pay for performance misalignment

The FTSE 100 CEO compensation landscape is evolving, with a growing emphasis on long-term incentives. However, the CGLytics study conducted on pay for performance alignment shows a material misalignment between pay and performance within many FTSE 100 companies during 2017:

- 33% of companies have a pay for performance misalignment

- 34% of companies display a strong alignment

- 32% of the companies show a conservative pay practice for the performance generated, compared to other FTSE 100 companies.

With the 2019 proxy season fast approaching, boards need to be fully prepared to engage with shareholders. Having the same information as proxy advisors and investors is fundamental to proxy season readiness and good governance decision-making.

CGLytics provides real-time governance risk analytics and solutions that provide actionable insight for companies, shareholders and proxy advisors. We empower boards of companies and investors with data analytics that enables good governance.

In preparation for the 2019 proxy season, CGLytics released its third annual FTSE 100 Proxy Season report. This series of articles summarise some of the key findings. Access the full insights and statistics by downloading the report.