With the launch of Disclosure Search, navigating the world’s most robust global disclosure dataset just became a whole lot easier. Make more informed decisions on issues like diversity, ESG, executive compensation, and COVID-19 by tapping into the world’s most robust disclosure dataset.

Disclosure Search helps organizations quickly understand how companies are tackling key issues such as ESG to make more informed decisions

Disclosure Search provides organizations with new means to filter millions of data points across public disclosures to effectively benchmark their programs against others to understand how companies are addressing key issues, what they are disclosing, and how it has changed over time.

The new functionality enables users to:

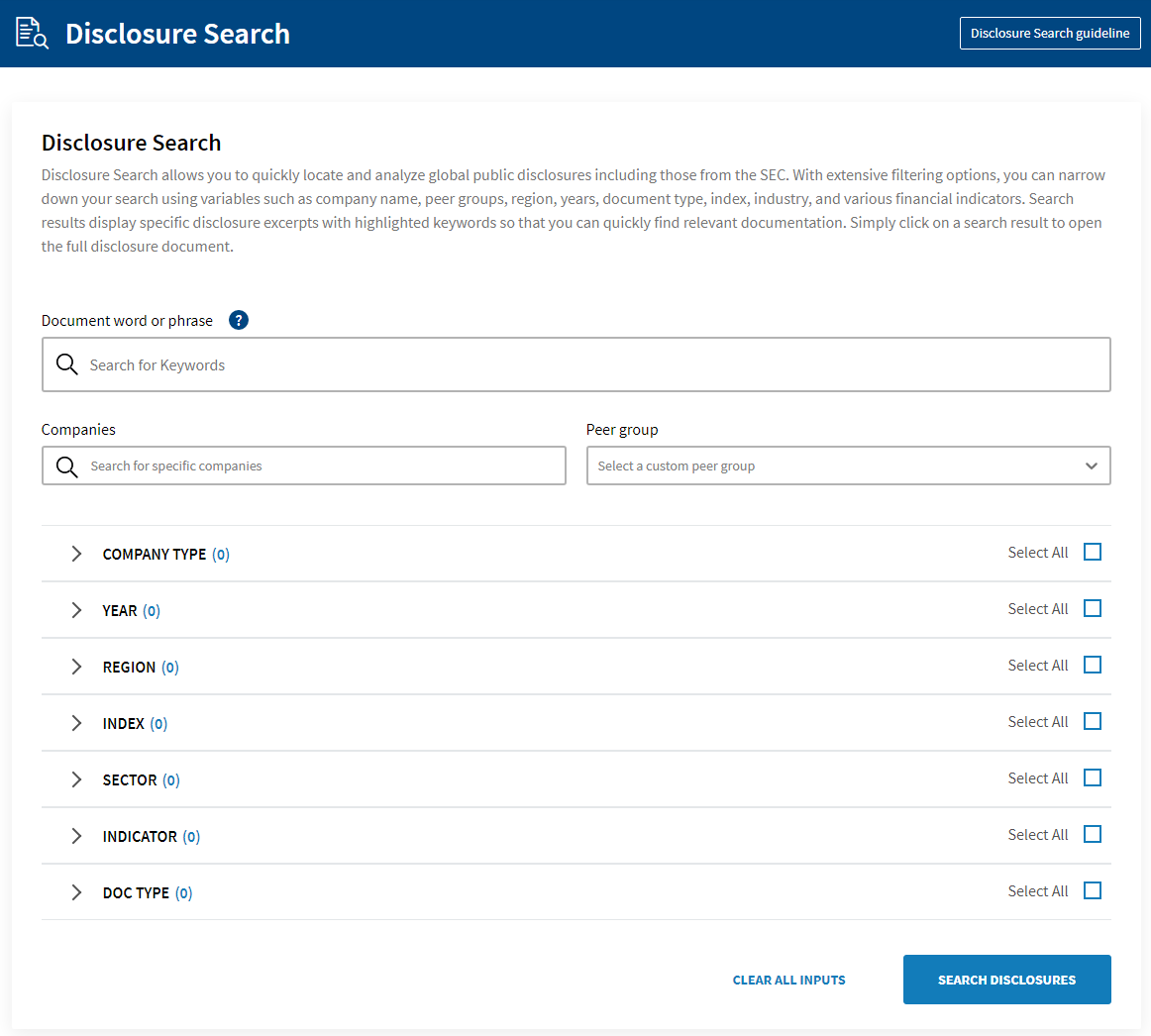

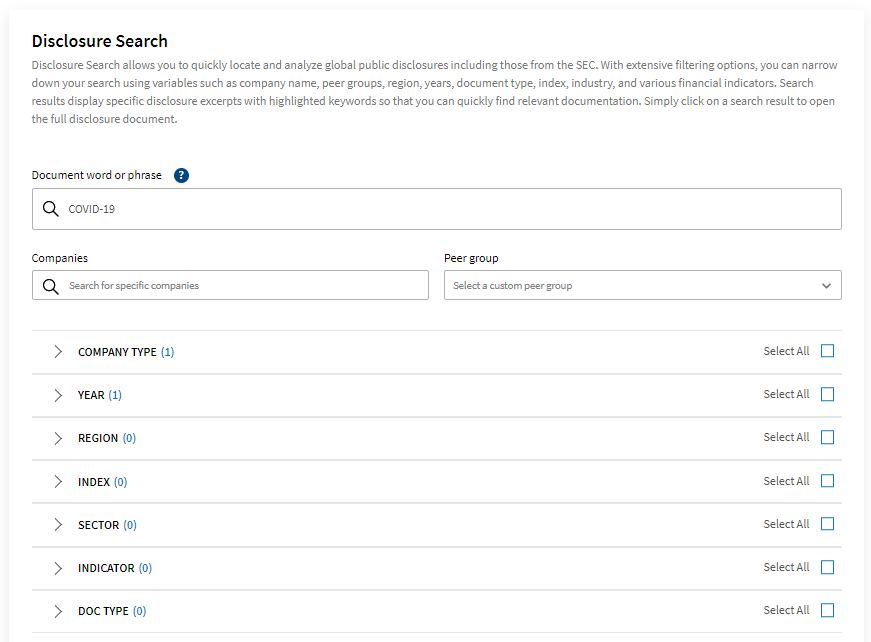

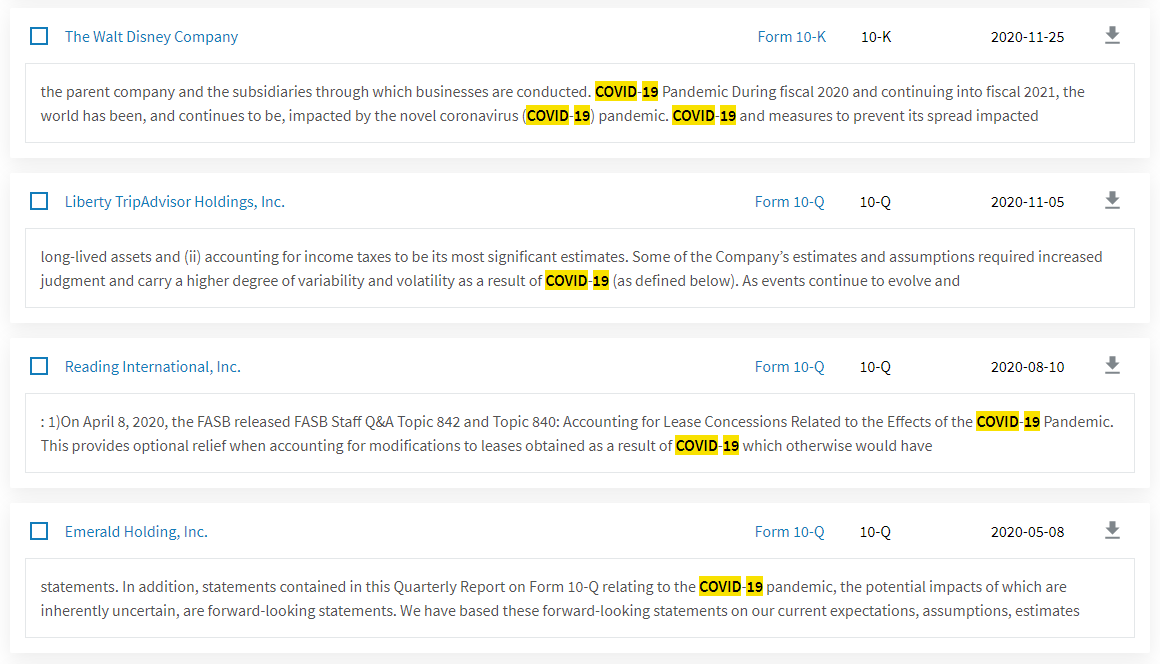

Quickly locate and analyze global public disclosures including those from the SEC.

Conduct deeper analysis on issues like diversity, ESG, executive compensation, and COVID-19 by incorporating public disclosure research across the Russell 3000.

Access key competitive intelligence using variables such as keywords of choice.

Receive real time email alerts with the latest filings (e.g., peer filings, competitor filings, etc.) to be the first to know about updates from peers and competitors.

Better understand decision areas such as executive compensation by reviewing disclosure narratives such as Compensation Discussion and Analysis (“CD&A”) across global markets.

Add real-time context to your quantitative analysis by tracking and reviewing disclosures from peers as they are filed.

In addition to offering Disclosure Search, CGLytics is the leading provider of executive & equity compensation analysis for the market globally – offering exclusive access to Glass Lewis’ latest compensation models to give organizations greater transparency into market expectations and put forward more favorable compensation plans.

With Over 1 Billion Data Points and Powerful Algorithms, CGLytics is Utilised by Leading Investors and Proxy Advisors.

125,000+

Director and Executive Profiles Compensation Details

10+

Years of compensation

data

A wealth of data

on compensation

arrangements

Long and short term incentive plan details

Intuitive Director/Executive Compensation benchmarking tool

Proprietary Pay for Performance Modeler

CGLytics' platform offers easy to use tools for accessing

10+ years of historical compensation data and performing

benchmarking analyses

Shareholder Engagement and Corporate Governance Solutions